- Gold slips but holds above 2,600

- Mixed technical signals point to further consolidation

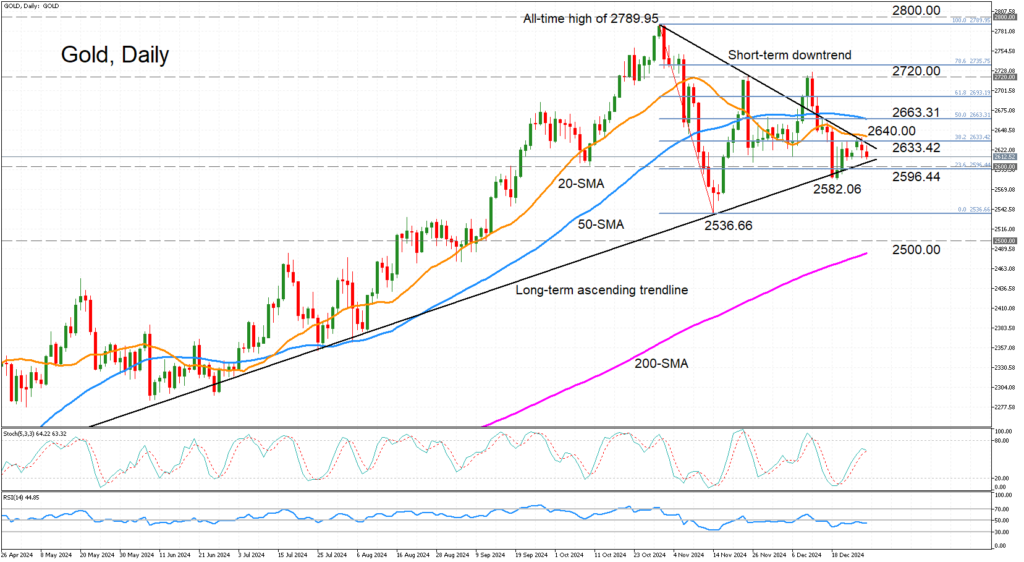

Gold is edging slightly lower on Monday, maintaining the tight trading range of the past week amid the thin volumes during the holiday period. From a technical perspective, the precious metal appears to be completing a bullish pennant, which suggests that an upside breakout is imminent.

However, the momentum indicators do not back a strong bullish picture in the near term. The stochastic oscillator’s upswing seems to be running out of steam, while the RSI has flatlined even before reaching the 50 neutral level.

Should the price continue to drift downwards, there’s likely to be strong support in the 2,600 area before reaching the December low of 2,582.06. A deeper slide would bring into scope the November trough of 2536.66. Breaching this too would risk extending the short-term negative correction into a medium-term downtrend and the spotlight would then turn to the 2,500 level and the 200-day simple moving average (SMA).

However, if gold manages to bounce higher, it will probably struggle to get past the 20-day SMA at 2640.00. But overcoming it would open the way until the 50% Fibonacci retracement of the October-November downleg at 2663.31, which is intersecting with the 50-day SMA. Clearing this tough hurdle would bring into focus another important resistance level at 2720.00.

All in all, gold looks poised to consolidate further in the near term. But a lot is riding on what happens next, as a break below 2536.66 would shift the medium-term neutral outlook to bearish, while a recovery above 2720.00 would turn it bullish.