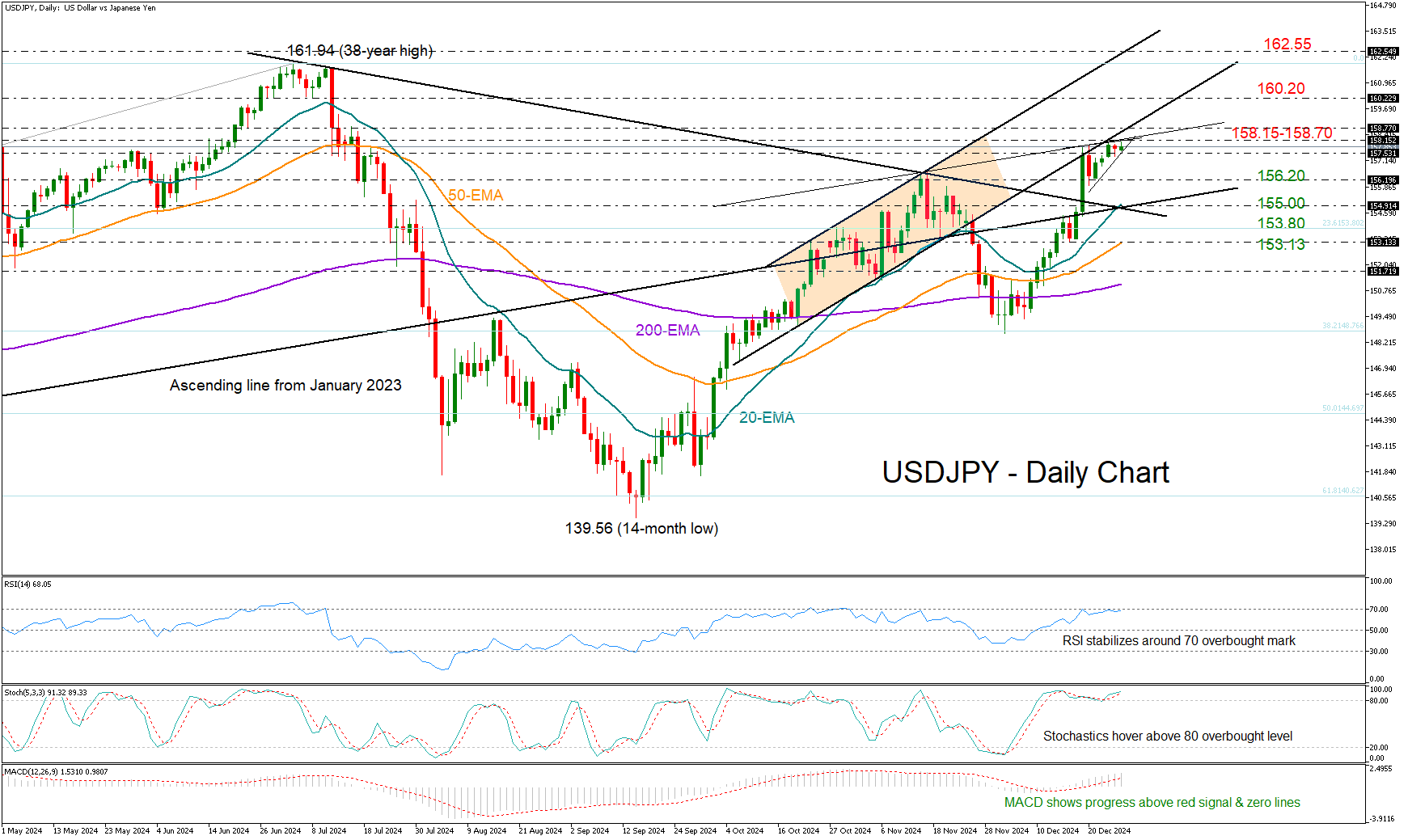

- USDJPY looks for bullish catalyst to break 158.00, with ISM Mfg. PMI ahead

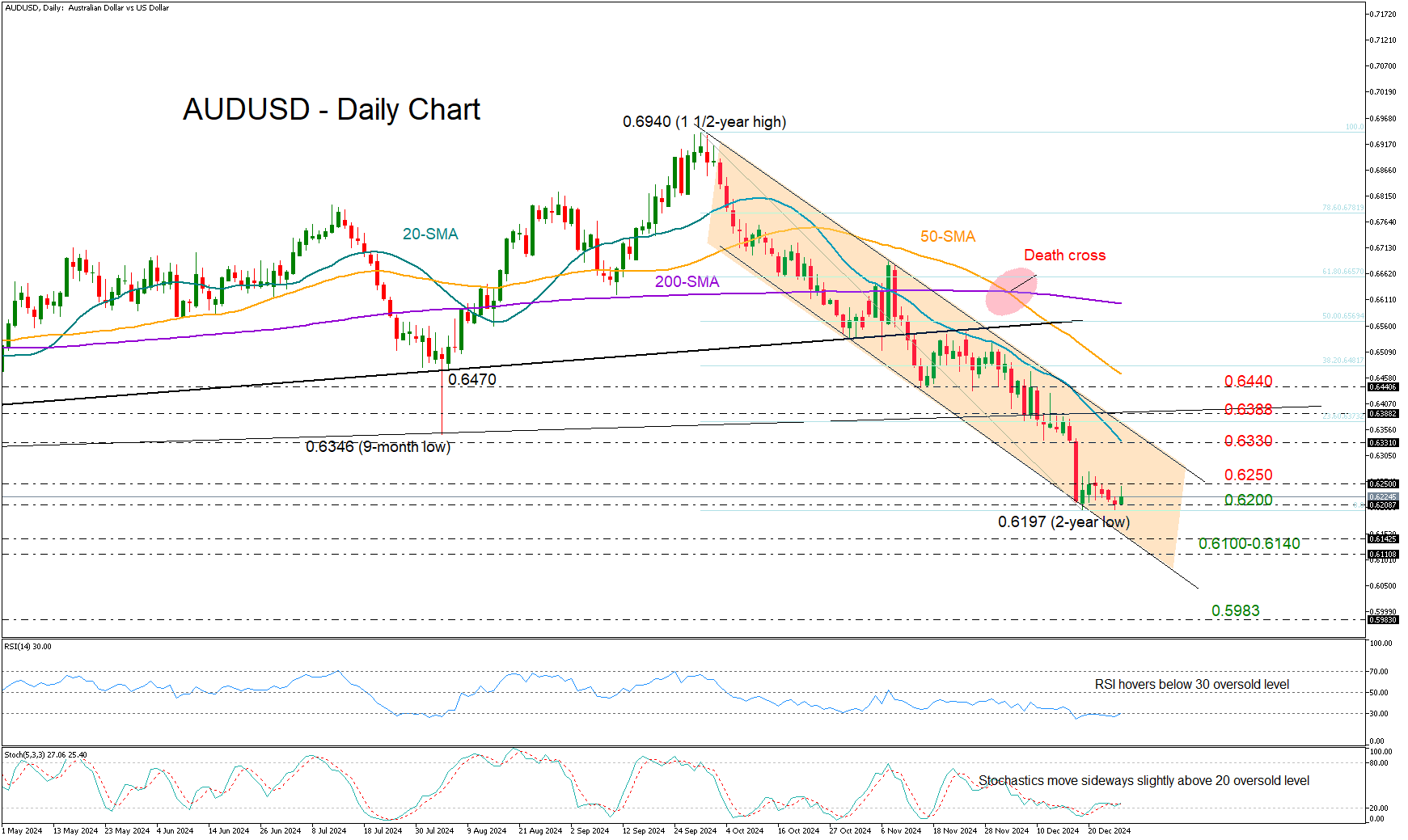

- AUDUSD remains bearish, consolidating near 0.6200 before Chinese PMIs

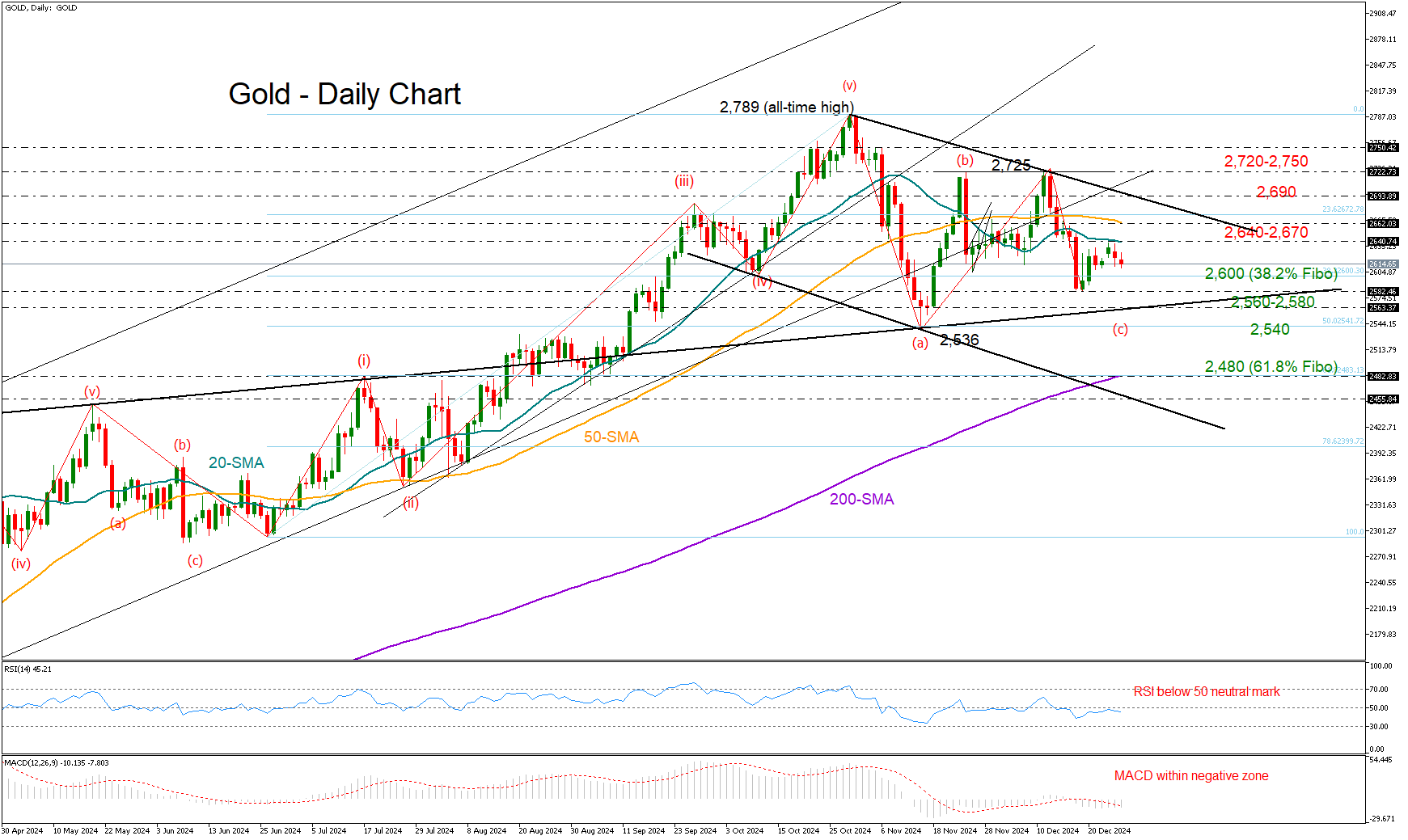

- Gold stays subdued below $2,640 amid ongoing geopolitical and economic risks

ISM manufacturing PMI –> USDJPY

Investors will be away from their desks to say goodbye to 2024, with trading conditions likely remaining thin most of the week. However, Friday’s release of the ISM Manufacturing PMI at 15:00 GMT could spark some volatility in USDJPY, which has been persistently testing the 158.00 level over the past couple of days.

USDJPY marked a notable acceleration in December, surging to a five-month high. Despite this upward momentum, caution is warranted, as technical indicators are flashing overbought signals.

The ISM manufacturing PMI is expected to stay steady at 48.4 for the second consecutive month in December. Focus will also be on the prices paid and employment sub-indices. Any positive surprises in these figures could provide additional support for the U.S. dollar, pushing the pair above the nearby resistance of 158.15-158.70 and toward 160.20. Beyond these, the 38-year high of 161.94 could come into play next.

However, growing speculation about potential FX intervention from the Bank of Japan (BoJ) casts doubt on the ability of bulls to sustain a rally above 160.00. If the U.S. data disappoints or if the pair slips below 157.50, it could seek shelter near 156.20, with a further pullback to 155.00 also possible

.

China NBS PMIs –> AUDUSD

China is set to release its NBS Manufacturing PMI on Tuesday, which could attract attention as the indicator has been gradually improving over the past three months. In contrast, the non-manufacturing PMI has been relatively stable.

The Australian dollar, which is highly sensitive to Chinese economic trends, is eagerly looking for a pivot after enduring 13 consecutive weeks of losses against the U.S. dollar. Currently, AUDUSD is attempting to establish support around the 0.6200 level, its lowest point in two years. If it holds this base, the pair could try to break through the 0.6250 resistance and target the 20-day simple moving average (SMA) at 0.6330.

However, if Chinese data disappoints, the pair could resume its downtrend, potentially testing the psychological 0.6100-0.6140 area. A step lower could cause a sharp decline to 0.5983 taken from April 2020.

Safe-haven demand –> Gold

As the year draws to a close, geopolitical tensions persist, with the situation in Ukraine ongoing and unrest in the Middle East continuing despite the ceasefire in Lebanon and the shifting dynamics in Syria following Assad’s decline. The potential impact of Donald Trump’s policies on resolving these conflicts remains uncertain. Hence, safe-haven assets such as gold could remain supported in the short term.

The $2,690-$2,725 region could be a tough obstacle on the upside, though to reach it, the price must first cross above its 20- and 50-day simple moving averages (SMAs).

On the technical front, gold struggled to close above its 20-day SMA at $2,640 last week, shifting the attention back to the $2,600 round number. The Fed’s hawkish stance on rate cuts has also been a drag on the precious metal. Should the upcoming manufacturing PMI data align with this outlook, gold could face further downside, potentially reaching the $2,560-$2,580 range and then the November low of 2,536. Failure to rebound there could activate strong selling pressures toward the 200-day SMA at $2,480.